You might have heard these terms used before and thought what do they mean? If you are a small business owner you might be thinking, what do they mean for my business, is it something that I can access, and can it help my business?

Real time accounting can be defined as the ability to access up to date financial information on your business on any device from anywhere in the world. Thanks to cloud computing and advancements in accounting technology and automation you can have access to all your latest business metrics such as cash balances, profit, revenue and working capital position. The metrics are easily accessible and can be presented visually through a dashboard generated through your accounting software.

Is it available for small business and will it help you manage and grow your business? Yes, definitely!

Most business owners are already using the software and technology but either due to a lack of understanding or by not having the right processes or people in place are not using it to its full potential.

Accounting software programs such as Xero are cost effective and provide a platform to produce real time financial information. These programs generate all your financial reports such as profit and loss statements and balance sheets as well as functionality to assist meeting compliance obligations such as STP reporting and business activity statement electronic lodgement.

Accounting software is now well advanced in its ability to automate accounting processes making it easier for small business owners and bookkeepers to keep accounting data up to date as well as ensuring it is accurate.

The automation also extends to document retention with electronic copies of expense receipts and supplier invoices easily uploaded through connected apps and stored within easy reach of each transaction within the accounting file. For example, most expense apps will upload and automatically create a draft transaction from a photo of the receipt, the photo is then stored with the transaction for easy access.

By connecting with industry applications, add-ons, and integrations products such as Xero become a powerful tool that can provide meaningful insights about your business in real time which means they are actionable. This is what I believe is the crux and the most important benefit of real time accounting – ‘the ability to allow users access to financial data that is actionable’.

And with cloud computing this financial information can be accessed from any device anywhere in the world.

There is an abundance of applications available that carry out functions such as job management, time tracking, payroll and HR services, customer relationship management, inventory management, reporting and payment services. Most are industry specific and have been tailored to suite particular industry types such as construction and trades, property, and realty.

All of these can be connected to accounting software products such as Xero and with daily syncs the information generated from the applications is uploaded into your accounting software. This means no rework is required, your accounting file is up to date and your financial data is consolidated in the one application allowing for meaningful reporting on all aspects of your business and accessible to all users.

The benefits of real time accounting are numerous but the following is a list of the key benefits small business owners will experience when using real time financial information:

- Improvements in cash flow management

- Faster measurement of upcoming liabilities such as GST and income tax payments

- Reduced error in meeting compliance obligations

- Access to profit and loss reporting whenever required

- Earlier detection into fraudulent activities

- A decrease in accounting costs

- Immediate access to accurate data

- Improved decision making

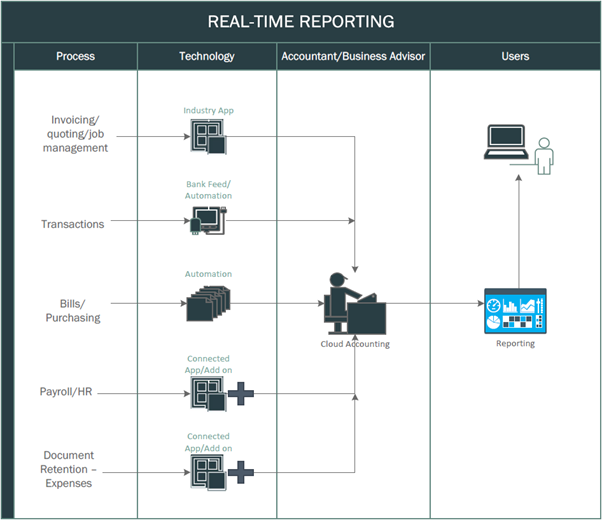

- Access to better data for analytics

The following flowchart provides the big picture on what real time reporting is all about. It illustrates the role technology now plays in converting the raw transaction data into meaningful information for users. With the output being a tailored report/dashboard that gives all users access to critical information about their business at their fingertips and in real time when needed.

Adcock Accounting embraces the technology now available and is proactive when working with clients in improving accounting processes leading to better reporting and outcomes. We are fast becoming experts in real time accounting and are available anytime to assist and support small business owners with their reporting needs. Please contact us for a free, no obligation consultation on how your business can access the benefits of real time reporting.

“Liability limited by a scheme approved under Professional Standards Legislation.”